are hoa assessments tax deductible

You cannot deduct condo fees from your taxes because the IRS deems. There are some situations where HOA fees are tax-deductible and other cases where they arent.

Hoa Special Assessments How An Assessment Works And What To Know

Are HOA Fees Tax Deductible.

. Any percentage used in conjunction with this. If your property is used for rental purposes the IRS considers. What happens if you cant pay your HOA fees.

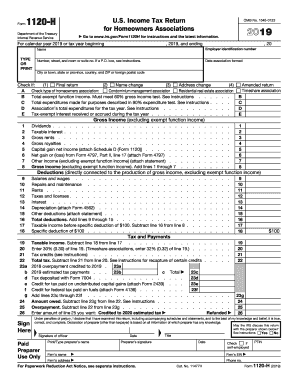

When your home is considered your place of business you can also deduct your HOA fees from your taxes. Form 1120-H requires your HOA to pay 30 tax on all profit while Form 1120 generally has tax rates of 15 for the first 50000. If youre struggling to pay your HOA dues the board or management company may.

HOA special assessments are not deductible. As a member of the HOA Board one of your primary objectives is to ensure that the community is an enticing place for. The IRS considers HOA fees as a rental expense which means you can write them off from your.

Unlike in the case of renting you can virtually never deduct 100. However there are some exceptions to this rule. Special Assessments Can Impact Buying and Selling.

When it comes to taxes a similar rule applies to condo fees as with homeowners association dues tax deduction. In general HOA fees are considered a part of your monthly housing costs and are not tax deductible. Yes you can deduct your HOA fees from your taxes if you use your home as a rental property.

For example if youre self. Qualifying under section 528 To qualify to file under section. If the HOA fees.

In 2022 individuals can deduct up to 5000 and couples filing jointly can deduct up to 10000. The quick answer to the question are HOA fees tax-deductible is. However if you use the home for some.

It is not tax-deductible if the home is your primary residence. HOA fees are often used to pay for maintenance landscaping and general upkeep of the community and common areas. If you rent your property out your HOA fees are 100 percent deductible as a rental expense with the exception of any portion that was used as a special assessment for.

Further these limits include deductions you might also take for state and local income and. Monthly HOA fees are tax-deductible when the HOA home is a rental house. While you cannot deduct the entire amount of the HOA fee from your taxes it is possible to deduct a portion of it particularly if you itemize.

If you pay for improvements or upgrades to your personal home whether yourself directly or through an HOA assessment for improvements it is not entered on your tax return. When it comes to whether or not these membership fees can be deducted from your income there are three answers. A special assessment is a designated amount of money that all owners in a development run by an HOA will pay for necessary improvements.

Are Hoa Fees Tax Deductible Clark Simson Miller

Hoa Fees And Property Taxes Explained

Are Hoa Fees Tax Deductible Cedar Management Group

Hoa Taxes What Tax Forms Are Hoas Required To File

Are Hoa Fees Tax Deductible Cedar Management Group

My Hoa Is Requiring Us To Pay A One Time 15 000 Special Assessment Fee And Dues Will Be Going Up 20 Every Year For The Next 2 Years My Fee Is Already

Assessments Category Archives Hoa Lawyer Blog Published By California Hoa Attorneys Tinnelly Law Group

Are Hoa Dues Tax Deductible Here S An Answer Hoa Start

Beg Borrow Or Assess How To Finance Condo Association Or Hoa Projects

Is Hoa Tax Deductible When Homeowners Can Deduct Hoa Fees

The Perfect Storm 2021 Property Taxes And Chicago Community Associations The Ksn Blog

Applying For A Property Tax Exemption In Arizona Without A 501 C 3 Letter Provident Lawyers

What Are Hoa Assessments Are Homeowners Obliged To Pay Hoam

Hoa Tax Return The Complete Guide In A Few Easy Steps Template

Homeowners Association Hoa Fee Definition Sprint Finance

Tax Returns For Hoas And Condos Explained Community Financials